The Impact of Inventory Management on Business Value

When it comes to running a successful business, inventory management might not be the first thing that comes to mind. However, it plays a crucial role in determining your company’s overall value and attractiveness to potential buyers or investors. Let’s dive into how effective inventory management can significantly impact your business’s worth. The Bottom […]

Introduction to the Different Investment Vehicles

When it comes to building wealth and planning for your financial future, investing plays a critical role. But with so many options available, navigating the world of investments can feel overwhelming. That’s where understanding investment vehicles comes in. Investment vehicles are the tools or methods you use seeking to grow your money. They range from […]

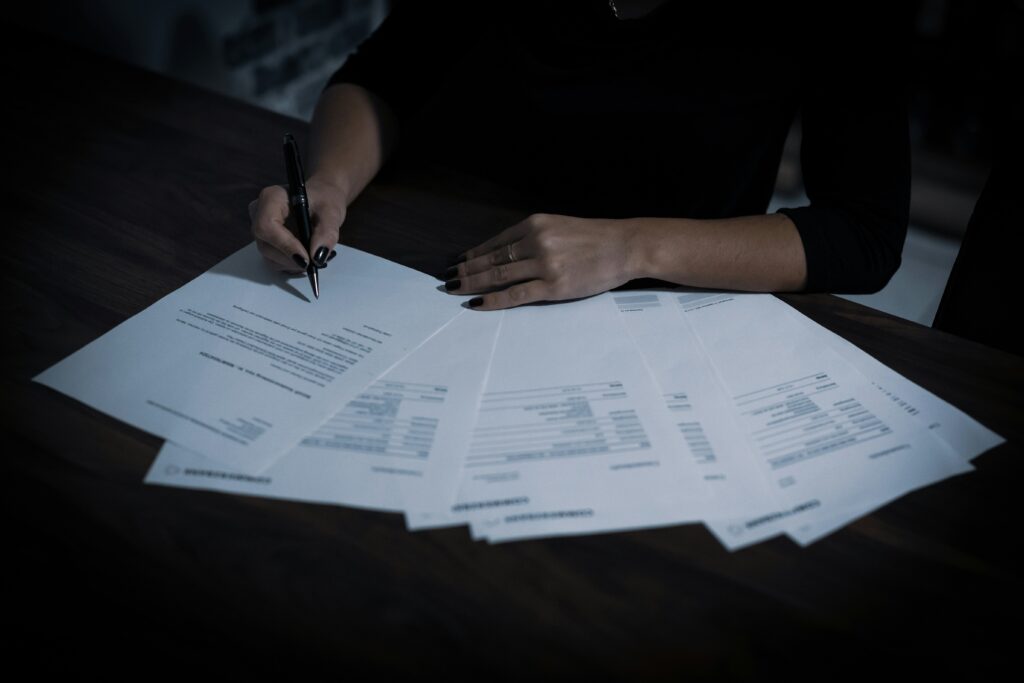

Cleaning Up Your Financial Records for Due Diligence

When you’re preparing to sell your business or seeking investment, getting your financial house in order is crucial. A thorough due diligence process is inevitable, and clean, accurate financial records can make or break a deal. Let’s walk through the key steps to ensure your financial records are in top shape for due diligence. […]

Understanding Credit Scores and Credit Reports

Your credit score isn’t just a number—it’s a key to unlocking financial opportunities. Whether you’re applying for a loan, renting an apartment, or even job hunting, your credit score and credit report play a crucial role in your financial journey. The better you understand them, the more control you have over your financial future. […]

Understanding and Improving Your Business’s Cash Flow

Cash flow is often described as the lifeblood of a business, and for good reason. It’s not just about profitability; it’s about having the liquid assets to keep your operations running smoothly day-to-day. Let’s dive into what cash flow really means and how you can improve it to ensure your business thrives. What Is […]

Strategies for Paying Off Debt

Paying off debt can feel overwhelming, but with the right strategy, you can take control of your finances and work toward a debt-free future. Whether you’re tackling credit card balances, student loans, or other financial obligations, having a clear plan will help you stay focused and motivated. Here are some effective strategies to accelerate your […]

Maximizing Retirement Savings Through Employer Plans

Maximizing your retirement savings through employer-sponsored plans is one of the smartest financial moves you can make. These plans, such as 401(k)s and 403(b)s, offer tax advantages, employer contributions, and long-term growth potential. Here’s how to make the most of them: 1. Contribute Enough to Get the Full Employer Match Many employers offer matching contributions, […]

Key Financial Documents to Prepare Before Selling Your Business

When you’re gearing up to sell your business, having your financial house in order is crucial. Not only does it make the process smoother, but it also instills confidence in potential buyers. Let’s walk through the essential financial documents you’ll need to prepare before putting your business on the market. Profit and Loss Statements First […]

Retirement Planning Basics-Starting Early

Imagine a future where you can retire confidently, travel the world, or simply enjoy life without financial stress. The key to making that a reality? Starting your retirement planning early. The sooner you begin, the more you can take advantage of compound interest, turning small contributions into significant wealth over time. Here’s how to get […]

The Role of Customer Relationships in Business Valuation

When it comes to valuing a business, there’s more to consider than just the numbers on a balance sheet. One of the most crucial yet often overlooked factors is the strength of customer relationships. Let’s dive into why these connections matter so much and how they can significantly impact your business’s worth. The Hidden […]