For the sixth time in the last seven years, the stock market is on track to deliver double-digit returns. This remarkable streak, interrupted only by the 2022 inflation-driven downturn, has left many investors in a positive financial position.

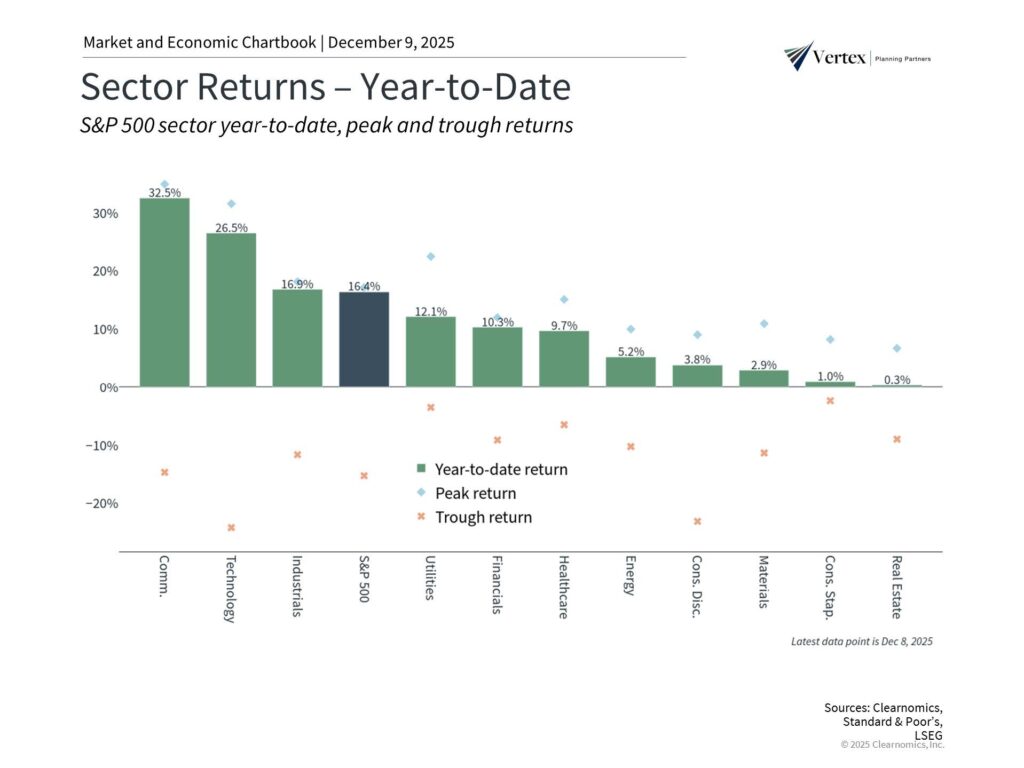

It’s often said that the anticipation of something is greater than the thing itself. On the one hand, investors always hope for strong returns like these, which are unequivocally positive for portfolios and financial goals. This is especially true as market performance has broadened beyond artificial intelligence-related stocks, international markets have rebounded, and fixed income has supported portfolios. On the other hand, once these returns are realized, investors tend to grow nervous, especially with major indices near all-time highs and valuations approaching historic dot-com peaks.

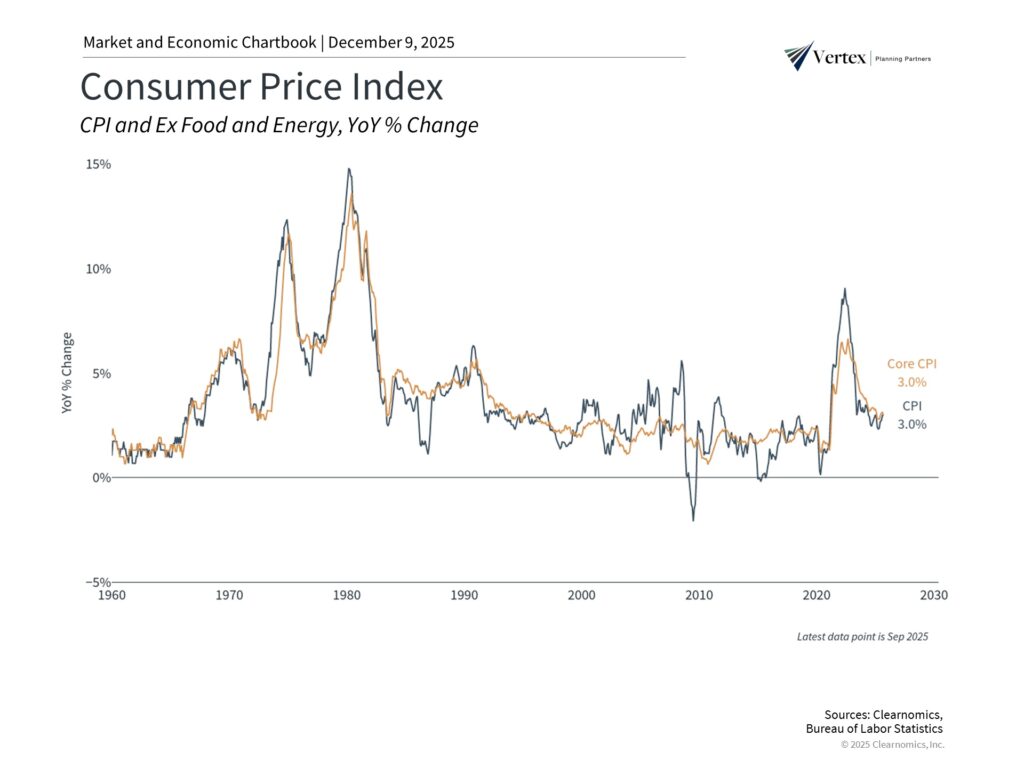

In 2025, there were turning points across many of the issues investors have faced over the past few years. Inflation, which is still affecting households, has stabilized around 3%. Tariffs, while high by historical standards and the main driver of stock market swings in 2025, have not resulted in the economic disruption many feared. The Federal Reserve has continued cutting rates, and the economy has grown at a healthy pace.

When we zoom out, perhaps the most important lesson to take into the new year is that what investors fear the most often doesn’t come to pass. The recession many have feared since 2022 did not occur. History suggests that for every genuine market disruption, like the 2020 pandemic or 2008 financial crisis, there are dozens of feared “black swans” – rare, unanticipated events – that never materialize. The challenge for long-term investors isn’t predicting which events will matter, but maintaining perspective and discipline across all market conditions.

As we look ahead to 2026, the investment landscape presents both opportunities and challenges. Topics likely to be in the headlines include the upcoming midterm election, a changing of the guard at the Federal Reserve, the future of AI, growing concerns around loans, the path of the U.S. dollar, and more. What matters most isn’t whether investors can forecast each twist and turn, but

whether their portfolio is positioned to weather uncertainty while capturing long-term growth. Here are seven key themes that can help guide how investors think about the year ahead.

1. Many asset classes are supporting portfolios into 2026

Importantly for investors, many asset classes are contributing to portfolio returns as we near 2026. This is in contrast to much of the past decade when U.S. stocks outperformed the rest of the world. In 2025, international stocks are outpacing

Importantly for investors, many asset classes are contributing to portfolio returns as we near 2026. This is in contrast to much of the past decade when U.S. stocks outperformed the rest of the world. In 2025, international stocks are outpacing

U.S. markets, with developed market stocks (MSCI EAFE) and emerging market stocks (MSCI EM) each gaining around 30% in U.S. dollar terms. This has been driven by two key factors: improving growth expectations in many economies and the weakening dollar, which boosts returns for U.S.-based investors.

Fixed income is also playing an important stabilizing role in portfolios. The Bloomberg

U.S. Aggregate Bond Index has gained 7% for the year as the Federal Reserve continues cutting interest rates and inflation stabilizes. Higher-quality bonds have been serving their purpose by providing income and offsetting stock market volatility during periods of market uncertainty.

In the coming year, this underscores the importance of balance and diversification. While it may be tempting to make sudden portfolio changes based on headlines, investors who stay on track with their financial plans are likely to be rewarded.

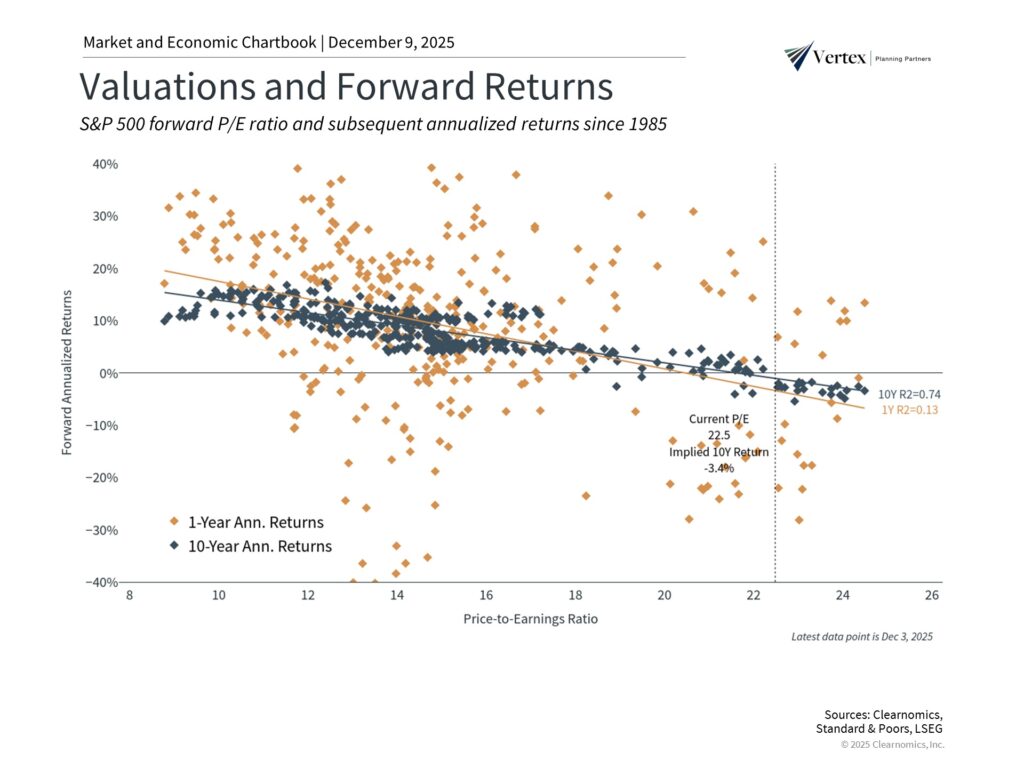

One effect of the strong returns of the past several years is that stock market valuations continue to rise. The S&P 500 currently trades at a price-to-earnings ratio of 22.5x, approaching the all-time high of

One effect of the strong returns of the past several years is that stock market valuations continue to rise. The S&P 500 currently trades at a price-to-earnings ratio of 22.5x, approaching the all-time high of

24.5x reached during the dot-com bubble. By definition, this means that investors are paying more for each dollar of future earnings than in recent years.

Investors typically worry about valuations when they become disconnected from the underlying fundamentals. For example, the dot-com bubble experienced historic valuation levels that far outpaced revenues and earnings, as investors rewarded any company related to the “new economy.”

While valuations are expensive today due to enthusiasm around AI and ongoing economic growth, corporate fundamentals remain strong. Earnings have grown at a healthy pace, with the

expectation they could continue to do so according to consensus estimates data by LSEG.

So, it’s important to recognize what high valuations do and do not tell us. Valuations don’t necessarily predict immediate market declines since markets can remain expensive for extended periods. While some investors worry about an “AI bubble,” the reality is that not all bubbles pop. Instead, some deflate slowly as the fundamentals catch up. This is one difference between the dot-com bust of the late 1990s and early 2000s and the growth of cloud computing over the past decade.

However, high valuations do suggest that returns could be more modest going forward, since markets are already accounting for future growth. This can also increase the market’s sensitivity to disappointments. Investors often say that markets like these are “priced for perfection,” so even minor misses on earnings or economic data can spur volatility. This means that being selective and maintaining balance across different parts of the market – including asset classes, sectors, sizes, styles, and more – will only grow in importance.

3. AI is driving economic growth and returns

Perhaps no single trend has captured investor attention more than AI. Capital expenditures on AI infrastructure reached extraordinary levels in 2025, with the total investment easily reaching trillions of dollars. This includes building new data centers, purchasing equipment such as GPUs, and hiring AI researchers.

Perhaps no single trend has captured investor attention more than AI. Capital expenditures on AI infrastructure reached extraordinary levels in 2025, with the total investment easily reaching trillions of dollars. This includes building new data centers, purchasing equipment such as GPUs, and hiring AI researchers.

Some of these investments involve deals that seem circular. For example, Nvidia invested up to $100 billion in OpenAI, which in turn is buying millions of Nvidia’s chips. These interconnected relationships have raised concerns about whether the AI ecosystem can sustain itself if enthusiasm wanes.

These trends reflect the reality that AI requires infrastructure that few companies can afford alone. The question is whether the technology will ultimately generate enough value to justify the enormous spending. As it stands, AI investment is currently a large contributor to the overall economy.

Surveys suggest that businesses are increasingly adopting AI into their workflows. According to the Census Bureau’s Business Trend and Outlook Survey, the share of businesses reporting use of AI more than doubled from 4% in September 2023 to 10% in September 2025. The share of businesses that anticipate using AI over the next six months rose at a similar rate, from 6% to 14%

over the same period.1 While these numbers have jumped, they still have significant room for growth.

For investors, AI presents both upside potential and downside risk. The Magnificent 7 technology companies continue to lead markets higher, driven by infrastructure investments and growing adoption of AI tools. However, this concentration creates vulnerability. These companies now represent about one-third of the S&P 500, meaning most investors have substantial exposure,

whether they realize it or not.

The challenge isn’t whether AI will transform the economy – it clearly will. Rather, it’s whether current valuations adequately reflect realistic timelines for returns on these massive investments. History from the railroad boom of the 1860s to the dot-com era of the 1990s shows that transformative technologies often follow similar patterns: initial skepticism, rapid adoption, market enthusiasm, and eventual integration into the broader economy.

The key lesson is that markets often overestimate the speed at which profits can be generated. The reality is that most investors likely have exposure to AI stocks whether directly or through major indices, so being aware of this concentration, and staying true to an appropriate asset allocation that fits with long-term goals, will be needed in the coming year.

4. Economic growth is slowing but remains positive

Economic growth trends have decelerated but remain stronger than many had feared.

Economic growth trends have decelerated but remain stronger than many had feared.

U.S. GDP experienced a slightly negative dip in the first quarter of 2025, but this rebounded quickly as tariff uncertainty faded. The 3.8% growth rate in the second quarter not only exceeded expectations, but is one of the strongest quarterly growth rates in years.

When it comes to global GDP, the International Monetary Fund projects that growth could ease just slightly from 3.2% in 2024 to 3.1% in 2026. Advanced economies are projected to grow around 1.5%, while emerging markets are

projected to maintain growth above 4%.2

Although positive in aggregate, economic growth has been uneven across different income groups and sectors. This concept is often referred to as a “two-speed” or “K-shaped” economy, since some experience growth while others struggle.

In today’s economy, this divergence is primarily driven by technology trends, since those positioned to benefit from the growth of AI could experience greater job prospects than those in traditional industries. However, it’s not just about AI, since consumer debt, auto loan delinquencies, and other financial challenges can affect whether individuals benefit from economic growth.

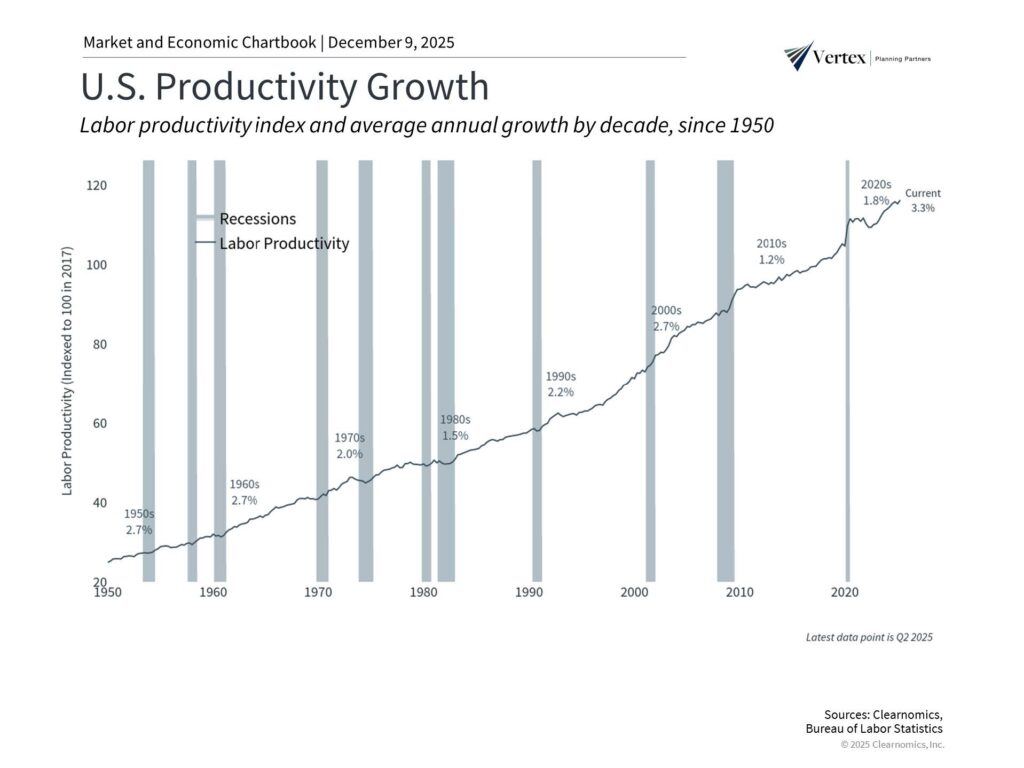

When it comes to long-term economic growth, perhaps the most important question is whether productivity will rise due to recent technological advances. Productivity measures how much, either in terms of quality or quantity, a worker can produce in a given amount of time. Historically, better equipment, training, and education have driven greater productivity, which is what drives real economic growth.

As the chart above shows, productivity growth averaged only 1.2% per year during the 2010s. The hope of AI and new technologies is a boost to worker output. However, this often takes longer than expected, and won’t necessarily benefit everyone equally. For investors, the promise of greater

productivity is that profit margins can improve, supporting the broader economy and investor portfolios.

5. The impact of tariffs remains uncertain

While tariffs were the primary driver of stock market volatility in 2025, their economic effects have been mixed. In fact, one of the ongoing puzzles is how little immediate impact tariffs have had on inflation and growth. Despite tariff costs increasing ten times their average level compared to prior years, measures such as the Consumer Price Index have ticked up only slightly.

While tariffs were the primary driver of stock market volatility in 2025, their economic effects have been mixed. In fact, one of the ongoing puzzles is how little immediate impact tariffs have had on inflation and growth. Despite tariff costs increasing ten times their average level compared to prior years, measures such as the Consumer Price Index have ticked up only slightly.

There are several possible explanations as to why tariffs have not had their anticipated effect. First, many of the announced tariffs were quickly paused or scaled back. Second, many companies absorbed the initial cost of tariffs by

keeping their prices steady and importing goods ahead of tariff announcements. Finally, strong consumer spending, fiscal stimulus, and healthy growth in AI-related sectors helped offset any negative impact on overall growth. It’s also worth noting that the Supreme Court may rule in 2026 on the legality of the economic justification used for these tariffs.

For long-term investors, these recent developments, along with the first round of trade negotiations in 2018, highlight the fact that tariffs are part of the government’s playbook. Rather than reacting to these tariffs as a shift in the world order, they instead represent tools for the administration to support broader policy goals. While tariffs aren’t going away, their impact on day-to-day market activity could diminish.

6. Midterm election and government debt will be at the forefront in 2026

In addition to changes in trade policy, 2025 also had a historic 43-day government shutdown and ongoing concerns over the size of the budget deficit. At the same time, the recently passed One Big Beautiful Bill Act (OBBBA) tax legislation has created more clarity for investors and taxpayers.

In addition to changes in trade policy, 2025 also had a historic 43-day government shutdown and ongoing concerns over the size of the budget deficit. At the same time, the recently passed One Big Beautiful Bill Act (OBBBA) tax legislation has created more clarity for investors and taxpayers.

The new year will begin with more uncertainty in Washington as the short-term funding bill expires at the end of January. This means there could be another wave of negotiations that could result in another government shutdown. Then, some investors expect households and businesses to benefit from greater tax

refunds due to provisions in the OBBBA such as full expensing of research and development.

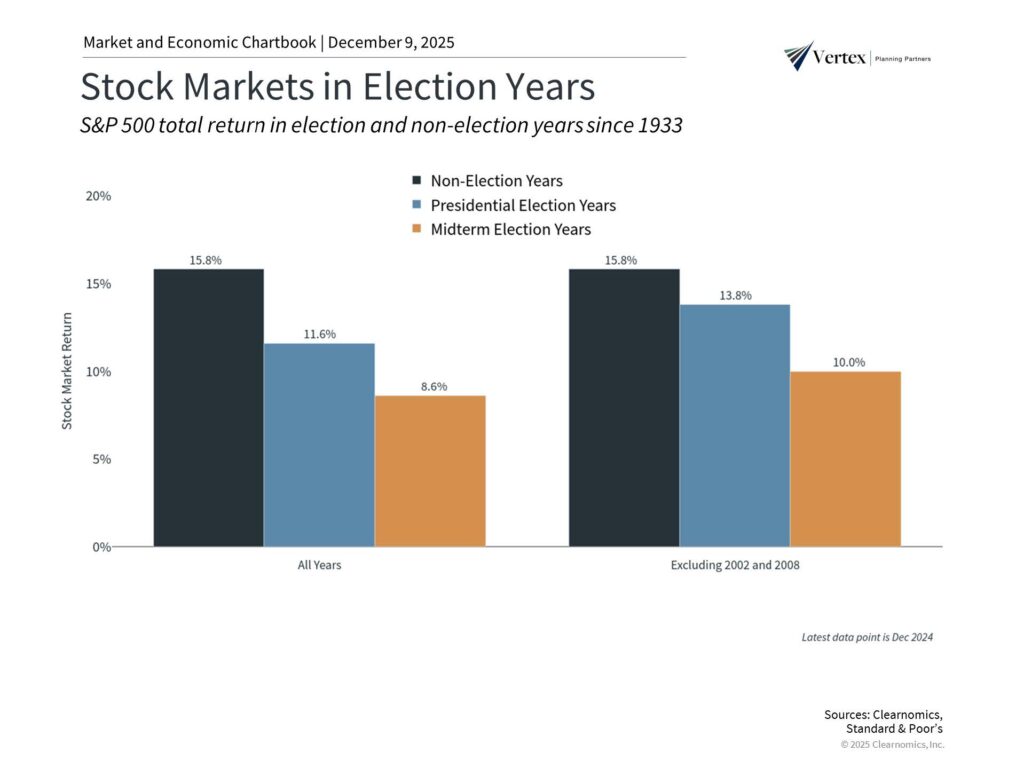

Looking further ahead, investors will likely shift their attention to the midterm election and what it could mean for tariffs, regulation, government spending, and more. The chart above shows that midterm elections have historically experienced healthy returns, averaging 8.6% since 1933, even if they are slightly lower than non-election and presidential election years.

Still, the biggest concern for many investors is the ever-growing national debt. The truth is that the historically high national debt, which is hovering around 120% of GDP for total debt, or over $36 trillion, is unlikely to be solved any time soon. In fact, it’s estimated that the OBBBA could increase the national debt by over $4 trillion in the next decade. As it stands, the national debt amounts to over $106,000 per American.

For long-term investors, it’s important to recognize what we can and cannot control. For example, the national debt has been a challenge for decades, yet investing based on these concerns would have resulted in the wrong portfolio positioning. While the sustainability of the U.S. federal debt may have implications for economic growth and interest rates, history shows that this should not be the primary driver of portfolios.

Instead, what investors can control in the short run is understanding the key changes to tax legislation and how it impacts long-term planning. These include the fact that lower tax rates from the Tax Cuts and Jobs Act are now permanent, estate tax exemption levels will remain higher, SALT deduction caps have risen, and many other provisions. It’s the perfect time to review your tax strategies to ensure you take full advantage of these new rules.

7. The Federal Reserve will support the economy

The Fed resumed cutting rates in September after pausing earlier in the year. As we enter 2026, the path of monetary policy could become less certain. This is because the risk of runaway inflation may no longer be the primary concern as a weaker job market has grown in importance. This requires tweaks to policy rates rather than dramatic shifts, such as those seen in 2022.

The Fed resumed cutting rates in September after pausing earlier in the year. As we enter 2026, the path of monetary policy could become less certain. This is because the risk of runaway inflation may no longer be the primary concern as a weaker job market has grown in importance. This requires tweaks to policy rates rather than dramatic shifts, such as those seen in 2022.

An additional complication is that Fed Chair Jerome Powell’s term will end on May 15, 2026, paving the way for new leadership at the Fed. The White House is expected to appoint a successor who may favor additional rate cuts to support the

administration’s economic agenda of lower interest rates.

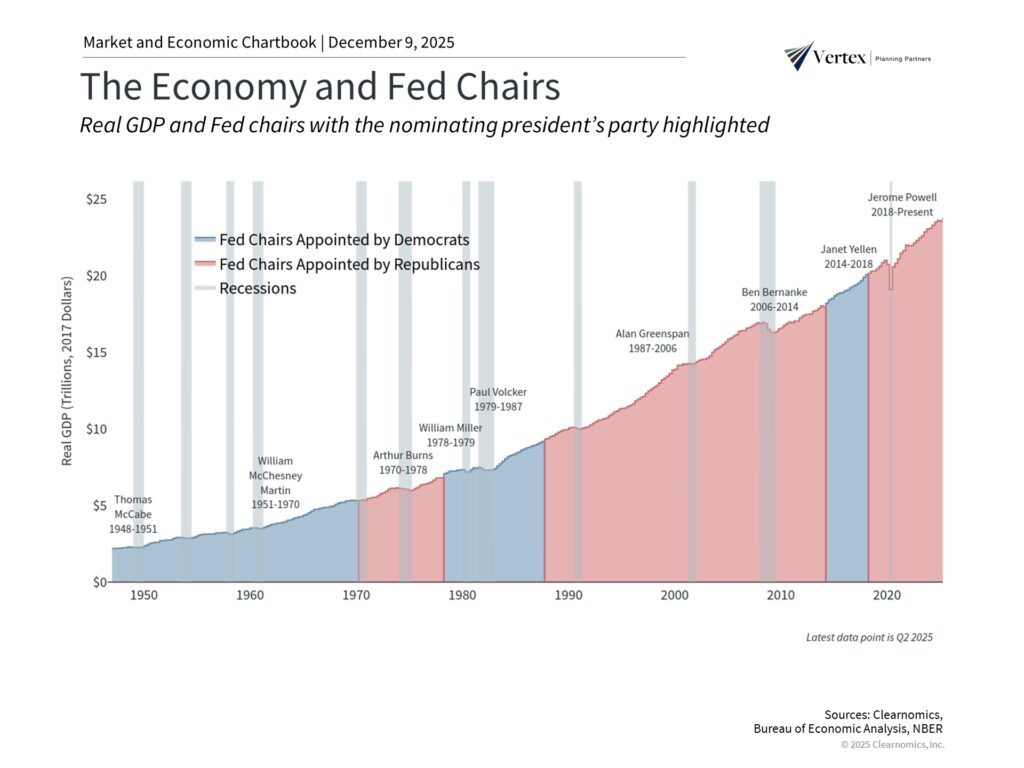

The chart above shows that the economy has performed well across Fed Chairs appointed by both parties. It’s important to note that the Fed only controls the “short end” of the yield curve, that is, interest rates that are closely tied to the federal funds rate. Long-term interest rates depend on many other factors, such as economic growth, inflation, and productivity. So, rather than follow the Fed’s every move and parse every statement, investors should continue to focus on these longer-term trends to understand the impact on interest rates and bonds.

Maintaining perspective in 2026

As we enter 2026, investors face a familiar challenge: balancing concerns with the reality that markets have consistently rewarded patient, disciplined investors over time. The list of worries is ever-present, yet history suggests that for every crisis that disrupts markets, many more feared events have failed to materialize. What separates successful long-term investors isn’t the ability to predict which concerns matter most, but the ability to stay balanced throughout all phases of the market cycle.

The bottom line?

Markets have delivered strong returns, but elevated valuations and slower global growth suggest more modest expectations for 2026. Rather than attempting to time the market based on any single concern, investors should focus on maintaining balanced portfolios positioned for various outcomes.

References

- https://www.census.gov/hfp/btos/data_downloads

- https://www.imf.org/en/publications/weo/issues/2025/10/14/world-economic-outlook-october-2025

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested in directly.

All investing involves risk, including loss of principal. No strategy assures success or protects against loss. The economic forecasts set forth in this material may not develop as predicted, and there can be no guarantee that strategies promoted will be successful.

Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular

needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company’s stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security–including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.

2026 Outlook: 7 Key Themes for Long-Term Investors

For the sixth time in the last seven years, the stock market is on track to deliver double-digit returns. This remarkable streak, interrupted only by the 2022 inflation-driven downturn, has left many investors in a positive financial position.

It’s often said that the anticipation of something is greater than the thing itself. On the one hand, investors always hope for strong returns like these, which are unequivocally positive for portfolios and financial goals. This is especially true as market performance has broadened beyond artificial intelligence-related stocks, international markets have rebounded, and fixed income has supported portfolios. On the other hand, once these returns are realized, investors tend to grow nervous, especially with major indices near all-time highs and valuations approaching historic dot-com peaks.

In 2025, there were turning points across many of the issues investors have faced over the past few years. Inflation, which is still affecting households, has stabilized around 3%. Tariffs, while high by historical standards and the main driver of stock market swings in 2025, have not resulted in the economic disruption many feared. The Federal Reserve has continued cutting rates, and the economy has grown at a healthy pace.

When we zoom out, perhaps the most important lesson to take into the new year is that what investors fear the most often doesn’t come to pass. The recession many have feared since 2022 did not occur. History suggests that for every genuine market disruption, like the 2020 pandemic or 2008 financial crisis, there are dozens of feared “black swans” – rare, unanticipated events – that never materialize. The challenge for long-term investors isn’t predicting which events will matter, but maintaining perspective and discipline across all market conditions.

As we look ahead to 2026, the investment landscape presents both opportunities and challenges. Topics likely to be in the headlines include the upcoming midterm election, a changing of the guard at the Federal Reserve, the future of AI, growing concerns around loans, the path of the U.S. dollar, and more. What matters most isn’t whether investors can forecast each twist and turn, but

whether their portfolio is positioned to weather uncertainty while capturing long-term growth. Here are seven key themes that can help guide how investors think about the year ahead.

1. Many asset classes are supporting portfolios into 2026

U.S. markets, with developed market stocks (MSCI EAFE) and emerging market stocks (MSCI EM) each gaining around 30% in U.S. dollar terms. This has been driven by two key factors: improving growth expectations in many economies and the weakening dollar, which boosts returns for U.S.-based investors.

Fixed income is also playing an important stabilizing role in portfolios. The Bloomberg

U.S. Aggregate Bond Index has gained 7% for the year as the Federal Reserve continues cutting interest rates and inflation stabilizes. Higher-quality bonds have been serving their purpose by providing income and offsetting stock market volatility during periods of market uncertainty.

In the coming year, this underscores the importance of balance and diversification. While it may be tempting to make sudden portfolio changes based on headlines, investors who stay on track with their financial plans are likely to be rewarded.

2. Market valuations are approaching dot-com levels

24.5x reached during the dot-com bubble. By definition, this means that investors are paying more for each dollar of future earnings than in recent years.

Investors typically worry about valuations when they become disconnected from the underlying fundamentals. For example, the dot-com bubble experienced historic valuation levels that far outpaced revenues and earnings, as investors rewarded any company related to the “new economy.”

While valuations are expensive today due to enthusiasm around AI and ongoing economic growth, corporate fundamentals remain strong. Earnings have grown at a healthy pace, with the

expectation they could continue to do so according to consensus estimates data by LSEG.

So, it’s important to recognize what high valuations do and do not tell us. Valuations don’t necessarily predict immediate market declines since markets can remain expensive for extended periods. While some investors worry about an “AI bubble,” the reality is that not all bubbles pop. Instead, some deflate slowly as the fundamentals catch up. This is one difference between the dot-com bust of the late 1990s and early 2000s and the growth of cloud computing over the past decade.

However, high valuations do suggest that returns could be more modest going forward, since markets are already accounting for future growth. This can also increase the market’s sensitivity to disappointments. Investors often say that markets like these are “priced for perfection,” so even minor misses on earnings or economic data can spur volatility. This means that being selective and maintaining balance across different parts of the market – including asset classes, sectors, sizes, styles, and more – will only grow in importance.

3. AI is driving economic growth and returns

Some of these investments involve deals that seem circular. For example, Nvidia invested up to $100 billion in OpenAI, which in turn is buying millions of Nvidia’s chips. These interconnected relationships have raised concerns about whether the AI ecosystem can sustain itself if enthusiasm wanes.

These trends reflect the reality that AI requires infrastructure that few companies can afford alone. The question is whether the technology will ultimately generate enough value to justify the enormous spending. As it stands, AI investment is currently a large contributor to the overall economy.

Surveys suggest that businesses are increasingly adopting AI into their workflows. According to the Census Bureau’s Business Trend and Outlook Survey, the share of businesses reporting use of AI more than doubled from 4% in September 2023 to 10% in September 2025. The share of businesses that anticipate using AI over the next six months rose at a similar rate, from 6% to 14%

over the same period.1 While these numbers have jumped, they still have significant room for growth.

For investors, AI presents both upside potential and downside risk. The Magnificent 7 technology companies continue to lead markets higher, driven by infrastructure investments and growing adoption of AI tools. However, this concentration creates vulnerability. These companies now represent about one-third of the S&P 500, meaning most investors have substantial exposure,

whether they realize it or not.

The challenge isn’t whether AI will transform the economy – it clearly will. Rather, it’s whether current valuations adequately reflect realistic timelines for returns on these massive investments. History from the railroad boom of the 1860s to the dot-com era of the 1990s shows that transformative technologies often follow similar patterns: initial skepticism, rapid adoption, market enthusiasm, and eventual integration into the broader economy.

The key lesson is that markets often overestimate the speed at which profits can be generated. The reality is that most investors likely have exposure to AI stocks whether directly or through major indices, so being aware of this concentration, and staying true to an appropriate asset allocation that fits with long-term goals, will be needed in the coming year.

4. Economic growth is slowing but remains positive

U.S. GDP experienced a slightly negative dip in the first quarter of 2025, but this rebounded quickly as tariff uncertainty faded. The 3.8% growth rate in the second quarter not only exceeded expectations, but is one of the strongest quarterly growth rates in years.

When it comes to global GDP, the International Monetary Fund projects that growth could ease just slightly from 3.2% in 2024 to 3.1% in 2026. Advanced economies are projected to grow around 1.5%, while emerging markets are

projected to maintain growth above 4%.2

Although positive in aggregate, economic growth has been uneven across different income groups and sectors. This concept is often referred to as a “two-speed” or “K-shaped” economy, since some experience growth while others struggle.

In today’s economy, this divergence is primarily driven by technology trends, since those positioned to benefit from the growth of AI could experience greater job prospects than those in traditional industries. However, it’s not just about AI, since consumer debt, auto loan delinquencies, and other financial challenges can affect whether individuals benefit from economic growth.

When it comes to long-term economic growth, perhaps the most important question is whether productivity will rise due to recent technological advances. Productivity measures how much, either in terms of quality or quantity, a worker can produce in a given amount of time. Historically, better equipment, training, and education have driven greater productivity, which is what drives real economic growth.

As the chart above shows, productivity growth averaged only 1.2% per year during the 2010s. The hope of AI and new technologies is a boost to worker output. However, this often takes longer than expected, and won’t necessarily benefit everyone equally. For investors, the promise of greater

productivity is that profit margins can improve, supporting the broader economy and investor portfolios.

5. The impact of tariffs remains uncertain

There are several possible explanations as to why tariffs have not had their anticipated effect. First, many of the announced tariffs were quickly paused or scaled back. Second, many companies absorbed the initial cost of tariffs by

keeping their prices steady and importing goods ahead of tariff announcements. Finally, strong consumer spending, fiscal stimulus, and healthy growth in AI-related sectors helped offset any negative impact on overall growth. It’s also worth noting that the Supreme Court may rule in 2026 on the legality of the economic justification used for these tariffs.

For long-term investors, these recent developments, along with the first round of trade negotiations in 2018, highlight the fact that tariffs are part of the government’s playbook. Rather than reacting to these tariffs as a shift in the world order, they instead represent tools for the administration to support broader policy goals. While tariffs aren’t going away, their impact on day-to-day market activity could diminish.

6. Midterm election and government debt will be at the forefront in 2026

The new year will begin with more uncertainty in Washington as the short-term funding bill expires at the end of January. This means there could be another wave of negotiations that could result in another government shutdown. Then, some investors expect households and businesses to benefit from greater tax

refunds due to provisions in the OBBBA such as full expensing of research and development.

Looking further ahead, investors will likely shift their attention to the midterm election and what it could mean for tariffs, regulation, government spending, and more. The chart above shows that midterm elections have historically experienced healthy returns, averaging 8.6% since 1933, even if they are slightly lower than non-election and presidential election years.

Still, the biggest concern for many investors is the ever-growing national debt. The truth is that the historically high national debt, which is hovering around 120% of GDP for total debt, or over $36 trillion, is unlikely to be solved any time soon. In fact, it’s estimated that the OBBBA could increase the national debt by over $4 trillion in the next decade. As it stands, the national debt amounts to over $106,000 per American.

For long-term investors, it’s important to recognize what we can and cannot control. For example, the national debt has been a challenge for decades, yet investing based on these concerns would have resulted in the wrong portfolio positioning. While the sustainability of the U.S. federal debt may have implications for economic growth and interest rates, history shows that this should not be the primary driver of portfolios.

Instead, what investors can control in the short run is understanding the key changes to tax legislation and how it impacts long-term planning. These include the fact that lower tax rates from the Tax Cuts and Jobs Act are now permanent, estate tax exemption levels will remain higher, SALT deduction caps have risen, and many other provisions. It’s the perfect time to review your tax strategies to ensure you take full advantage of these new rules.

7. The Federal Reserve will support the economy

An additional complication is that Fed Chair Jerome Powell’s term will end on May 15, 2026, paving the way for new leadership at the Fed. The White House is expected to appoint a successor who may favor additional rate cuts to support the

administration’s economic agenda of lower interest rates.

The chart above shows that the economy has performed well across Fed Chairs appointed by both parties. It’s important to note that the Fed only controls the “short end” of the yield curve, that is, interest rates that are closely tied to the federal funds rate. Long-term interest rates depend on many other factors, such as economic growth, inflation, and productivity. So, rather than follow the Fed’s every move and parse every statement, investors should continue to focus on these longer-term trends to understand the impact on interest rates and bonds.

Maintaining perspective in 2026

As we enter 2026, investors face a familiar challenge: balancing concerns with the reality that markets have consistently rewarded patient, disciplined investors over time. The list of worries is ever-present, yet history suggests that for every crisis that disrupts markets, many more feared events have failed to materialize. What separates successful long-term investors isn’t the ability to predict which concerns matter most, but the ability to stay balanced throughout all phases of the market cycle.

The bottom line?

Markets have delivered strong returns, but elevated valuations and slower global growth suggest more modest expectations for 2026. Rather than attempting to time the market based on any single concern, investors should focus on maintaining balanced portfolios positioned for various outcomes.

References

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested in directly.

All investing involves risk, including loss of principal. No strategy assures success or protects against loss. The economic forecasts set forth in this material may not develop as predicted, and there can be no guarantee that strategies promoted will be successful.

Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular

needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company’s stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security–including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.

Share This: