The Impact of Recurring Revenue on Business Valuation

When it comes to valuing a business, few factors are as influential as recurring revenue. This predictable income stream has become a golden standard for buyers and investors, significantly impacting how businesses are valued in today’s market. Let’s explore why recurring revenue is so crucial and how it can boost your company’s worth.. The […]

Special Update: How $100 Oil and the Middle East Conflict Affect Investors

The ongoing conflict in Iran and the effective closure of the Strait of Hormuz have pushed oil prices sharply higher. Both Brent crude and WTI have jumped from around $70 per barrel to around $100 in just a few days, approaching levels last seen in 2022 when Russia invaded Ukraine. This has driven significant uncertainty […]

Special Update: Iran and Long-Term Investing

As you have seen in the news, the U.S. and Israel have launched military strikes against Iran, targeting its leadership, military assets, and nuclear infrastructure. Iran’s Supreme Leader is confirmed to have been killed, and Iran has retaliated with missile and drone attacks across the Middle East. President Trump has stated that the goal of […]

Supreme Court Tariff Ruling: Key Takeaways for Investors

After nearly a year of trade policy uncertainty, the Supreme Court’s ruling that recent tariffs are unconstitutional has reset the policy landscape. Yet, as is often the case in Washington, when one chapter closes, another opens. President Trump has already signaled a switch to an alternative legal framework for tariffs, and markets are still digesting […]

Jobs, Inflation, and Growth: Is the Economy Healthy?

The health of the economy is important to long-term investors because it drives their portfolios and their financial plans. Recent economic data points have sent mixed signals, leaving some investors unsure of what to make of the current environment. However, just as a doctor doesn’t diagnose a patient based on a single number, investors should […]

How Equity Compensation Fits into Your Financial Plan

For many professionals today, equity compensation is not just a nice perk, but a significant source of wealth accumulation over their careers. Whether through restricted stock units (RSUs), stock options, or other forms of company equity, these awards have become increasingly common across industries and job levels. However, with this type of compensation comes complexity. […]

Smart Money Moves: Budgeting Tips and Money Management Basics for Young Adults

Building a strong financial foundation in your 20s and 30s can set the tone for decades to come. Whether you’re starting a career, paying off student loans, or saving for future goals, learning to manage your money effectively is one of the most empowering steps you can take. The good news? You don’t need to […]

Is AI Eating the World? A Portfolio Perspective

Fifteen years ago, venture capitalist Marc Andreessen famously wrote that “software is eating the world.” What he meant was that any service that could be written and automated as software, would be. This has proved accurate as cloud computing, software-as-a-service, and digital platforms have reshaped both entire industries and how consumers buy goods and services. […]

Using Behavioral Finance to Set Investor Expectations

The strong stock market performance of the past several years has been positive for investors and their financial plans. At the same time, these recent successes can lead to unrealistic expectations when it comes to long-term financial goals. This is because investing and financial planning occur through all parts of the cycle, in both good […]

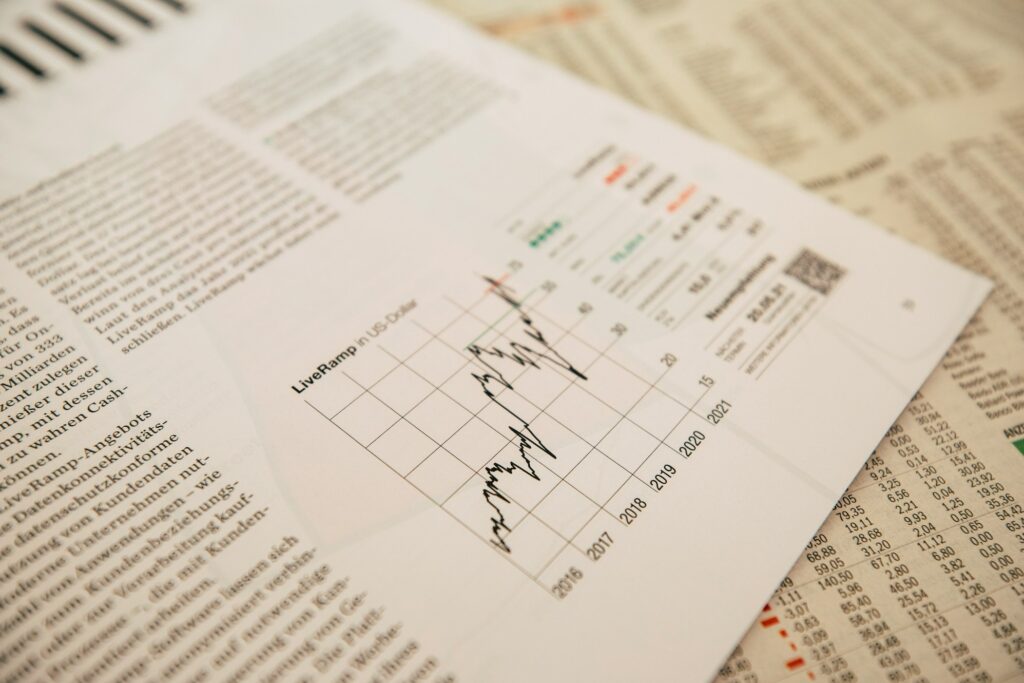

Monthly Market Update for January: Geopolitics, the Fed, and Precious Metals

The start of the year was positive for stocks and bonds, continuing the rally from recent years. This might be surprising to some investors since there were several periods of volatility driven by geopolitics and Federal Reserve policy. While headlines created short-term swings, including the S&P 500’s worst day since last October, markets rebounded quickly. […]