Connecting with Vertex Planning Partners is your first step towards a tailored financial future. Reach out to discuss guidance that aligns with your unique financial goals and aspirations.

Schedule a meeting with a Vertex Planning Partner Advisor who will answer any questions you might have.

p: 630.836.3300 – e: in**@************rs.com

We’re here to help. Email or call us and speak with a Vertex Planning Partner Advisor who will answer any questions you might have: 630.836.3300 or in**@************rs.com

Enter your email to download our Independent Advisors eBook and unlock the secrets to a tailored financial future.

Enter your email to download our PATH eBook and unlock the secrets to a tailored financial future.

Peter Babilla brings 40 years of experience in investment management and fiduciary* financial consulting to Vertex Planning Partners, LLC.

Pete graduated from Indiana University in Bloomington, Indiana with a Bachelor’s of Science in Finance.

He began his career in 1983 with a focus on institutional fixed-income portfolio management, primarily working with community banks. After a decade serving institutional clients, Pete shifted his focus to working with individuals, families and business owners, providing guidance and education in all areas of Wealth Management. Among his areas of focus are accumulation and retirement planning, investment management, risk management, and estate and wealth transfer.

Pete’s planning philosophy allows him to create a personalized program for clients, based on their own unique goals and circumstances. The extensive investment and planning platform offered by Vertex enables him to create a highly customized program, tailored to each individual client.

Pete and his wife Suzanne have two children, and have resided in Wheaton, Illinois for the past 30 years. He enjoys golf, reading, and traveling with his family. Pete gives back as a past Board Member of the Epilepsy Foundation of Greater Chicago, where his focus is on improving the lives of those living with epilepsy.

Pete works as fiduciary for his clients and holds the CERTIFIED FIANANCIAL PLANNER™ (CFP®) designation and the Chartered Retirement Plan Specialist (CRPS®) designation.

Justin D’Agostino joined Vertex Partners in 2019 and serves a select group of business owners and affluent families. He specializes in investments, financial planning, and succession planning. His interest and knowledge in providing comprehensive financial planning and wealth management services to clients was sparked when he worked at a boutique tax and wealth management firm in Michigan. He has nine years of experience in the financial services industry, and his mission is to provide every client with targeted, comprehensive financial advice and to help them implement customized strategies designed to move them closer to accomplishing their unique goals.

Justin attended Hillsdale College where he earned his BA in Accounting and Financial Management and was a member and captain of the football team. Justin is a CERTIFIED FINANCIAL PLANNER™ Professional, holds the Chartered Financial Consultant® and Chartered Retirement Planning Counselor™ designations.

Justin and his wife, Alexandra, reside in Chicago, Illinois. He is an avid sports fan and enjoys golfing, playing soccer and spending summer weekends with his family.

Scott Sandee brings over 20 years of experience as Managing Partner. He is responsible for leading the firm’s efforts in assisting middle-market business owners and seven and eight-figure families to plan and realize financial goals based on their unique aspirations and situations.

With a privately held family business background, Scott has helped owners prepare for and execute a successful transition. In addition, he works with business owners and their advisors to develop financial strategies to maximize sales proceeds and minimize future taxes.

Before joining Vertex, Scott served in financial planning and investment strategy roles at Oxford Financial Group, Capital Group, and The Northern Trust Company, working with Chicago’s HNW/UHNW families clients.

Scott holds the Certified Financial Planner®, Certified Private Wealth Advisor®, Certified Investment Management Analyst®, and Certified Exit Planning Advisor designations. Scott earned his B.S. in Computer Science from Northern Illinois University, and his family resides in Wilmette, IL.

Julie Hupp, CERTIFIED FINANCIAL PLANNER™ professional, has worked in the accounting and corporate finance field since 1987. She began her career as a CPA with Deloitte & Touche, specializing in the financial needs of small businesses. Then spent the next 13 years in corporate financial planning and business development at Baxter and TAP Pharmaceuticals. Recognizing her passion for personal financial planning, Julie started her business in 2006 where she focuses on comprehensive financial planning strategies and implementation.

Julie graduated from University of Illinois with a BS in Accountancy. She received her Master’s in Management with a concentration in Finance from Northwestern University’s Kellogg School of Management in 1994.

Outside the office, Julie is the co-founder of the 12 Oaks Foundation, which has merged with Cal’s Angels, and is a former Board member. Julie enjoys cooking, reading, running, triathlons and doing almost anything outdoors. A great weekend is spending time with her husband and two adult kids boating at their lake house in Wisconsin.

Steven P. Franzen, CPA, PFS, CGMA is a public accountant and consultant with more than 23 years of experience helping individuals and businesses reduce their tax liability. He began his career under the guidance of Patrick M. De Sio, CPA, CGMA and in 1996 became Mr. De Sio’s partner in De Sio, Franzen & Associates, Ltd. Steve’s expertise include entity design, complex tax strategies and multigenerational wealth transfer. As Managing Partner, Steve conducts his practice under the philosophy that the client’s investment in their CPA should yield a return on that investment – most of the time that return is realized when working with clients on planning for their future. In an effort to increase the planning capabilities of the firm, Steve formed Vertex Accounting Partners, LLC to ensure their guiding philosophy will continue well into the future.

Steve is a certified public accountant and has earned the professional designations of Personal Financial Specialist and Chartered Global Management Accountant. He is a member of the American Institute of Certified Public Accountants and the Illinois CPA Society. Steve earned a B.S. degree in accounting from Millikin University. He and his wife Kristie live in Sugar Grove, IL with their three children.

Gregory P. Benner, CPWA®, CFP®, ChFC®, CLU®, AIF®, RMA® has over twenty-two years of experience as a financial advisor. Greg’s practice is based on developing holistic financial plans that help his clients integrate sophisticated retirement, tax, risk management and estate planning strategies into an actionable plan, then stay the course as their behavioral coach.

Prior to founding Vertex Planning Partners, LLC, Greg spent four years as a founding partner of a Registered Investment Advisory firm affiliated with LPL Financial. He also spent seven years with JPMorgan Chase as a Senior Financial Advisor and was a Financial Representative with Northwestern Mutual Life.

Greg holds the Certified Private Wealth Advisor® designation and is a CERTIFIED FINANCIAL PLANNER™ Certificant. He also holds the Chartered Financial Consultant®, Chartered Life Underwriter®, Accredited Investment Fiduciary™, and Retirement Management AdvisorSM designations. He earned a B.S. in Finance from Miami University.

He and his wife Lindsey reside in Naperville, IL with their daughter and twin sons.

Michael D. Bellis, CFP®, CLU® began his career as a financial planning professional in 1994. His practice is centered on holistic financial planning, astute risk management strategies and empirical, research-driven portfolio construction. He began his career in partnership with his father under the name Bellis & Associates. Together, their practice and reputation for excellence dates back more than 40 years and includes multiple generations of the same families. After his father’s retirement several years ago, Mike continued to build a client-centric, consultative practice before forming Vertex.

Mike holds the CERTIFIED FINANCIAL PLANNER™ certification and is also a Chartered Life Underwriter. He has been an active member of both the Society of Financial Services Professionals and the National Association of Insurance and Financial Advisors. He earned a B.S. in Business & Marketing from Illinois State University. Mike is a lifelong resident of Naperville, Illinois. He and his wife Tanja have three children.

How Government Shutdowns Affect Markets and the Economy

Washington is back in the headlines as the federal government faces a shutdown if policymakers can’t reach a new funding agreement. This adds to a year in which government policies around trade, taxes, immigration, and more have created uncertainty for the economy and markets.

For investors, it’s natural to wonder how politics might affect their portfolios, especially for those concerned about the size of the budget deficit and national debt. Understanding the historical patterns, and why markets generally look past them, can help investors maintain perspective during periods of political gridlock.

Political drama in Washington can create uncertainty, but history shows that government shutdowns typically have limited impact on financial markets. While the toll that shutdowns have on government workers can be real, their effect on financial markets has historically been minimal. For long-term investors, these episodes highlight the need to separate political views from financial plans. This is especially important when daily headlines focus on controversial topics that have not historically affected portfolios.

Government shutdowns have not historically affected markets or the economy

It’s rare for Congress to pass budget bills on time. This may not be surprising given the increasingly polarized political environment in Washington, where compromise has become more difficult to achieve. Over nearly fifty years, Congress has managed to pass appropriations bills before the fiscal year deadline only a few times, making last-minute negotiations the norm rather than the exception. One solution that Congress has used often is known as a “continuing resolution” which temporarily funds the government while lawmakers negotiate. Republicans are currently proposing a seven-week stopgap bill for this purpose.

As the accompanying chart shows, government shutdowns have occurred regularly since 1980 under presidents of both parties, with minimal long-term impact on financial markets. The chart illustrates that this was true even during the most contentious shutdowns, including during the Reagan administration, Clinton’s 21-day shutdown in 1995, Obama’s 16-day shutdown in 2013, and Trump’s 35-day shutdown in late 2018 to early 2019 – the longest on record. For investors, shutdowns have generally served as temporary disruptions rather than fundamental threats to economic growth.

Shutdowns reflect deeper political differences

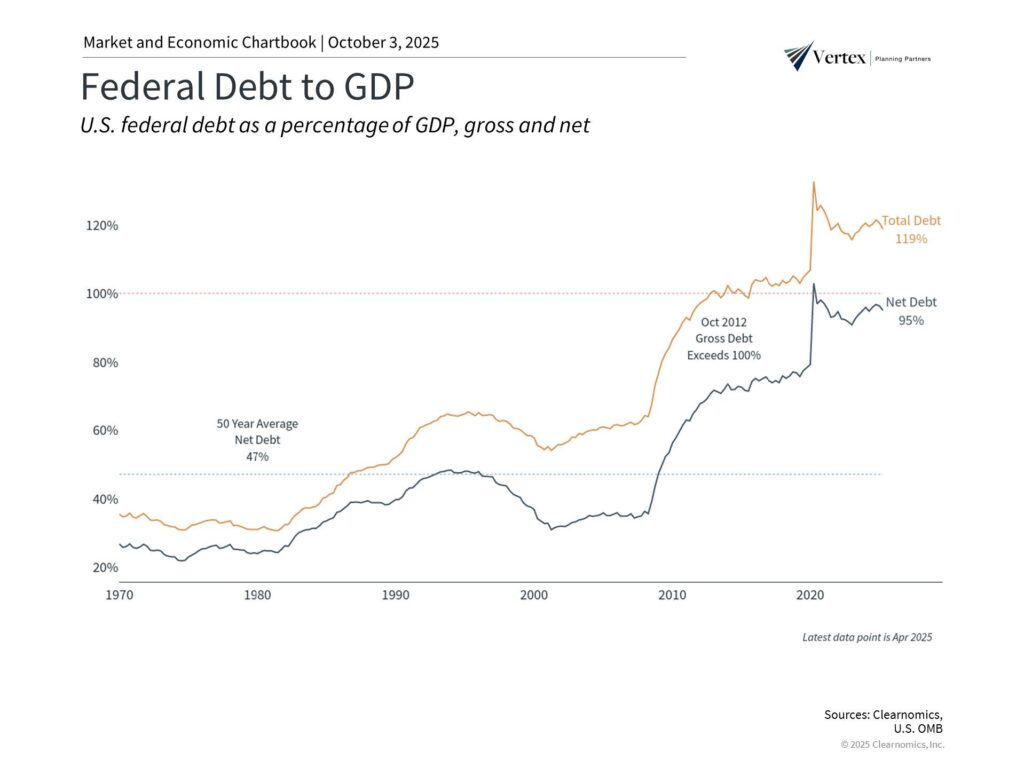

The current situation reflects disagreements over spending priorities, primarily around healthcare. While the immediate funding of the government is the focus, these budget battles reflect deeper differences around the role of government and fiscal responsibility. With federal debt now around 120% of GDP, many agree on the need for fiscal discipline but there is fundamental disagreement as to how this should occur.

The current situation reflects disagreements over spending priorities, primarily around healthcare. While the immediate funding of the government is the focus, these budget battles reflect deeper differences around the role of government and fiscal responsibility. With federal debt now around 120% of GDP, many agree on the need for fiscal discipline but there is fundamental disagreement as to how this should occur.

What makes this situation unique is the administration’s directive for agencies to prepare permanent workforce reduction plans beyond typical temporary furloughs. This represents a departure from previous shutdown patterns and could create longer-lasting impacts on the job market and fiscal spending. Note that furloughed federal workers do automatically receive back pay once the shutdown ends, a policy that was enacted as part of the negotiations that ended the 2018 to 2019 shutdown.

For some investors, the threat of a government shutdown may blend in with other fiscal issues such as the debt ceiling. The debt ceiling becomes a problem when spending the government has already approved needs to be paid for, but the Treasury Department isn’t authorized to borrow above a certain limit. The only solution in these cases is for Congress to raise the debt limit, or else the government risks defaulting on its obligations. All of these fiscal challenges are one reason the major credit rating agencies have downgraded the U.S. debt below AAA. Fortunately, the One Big Beautiful Bill Act also raised the debt ceiling by $5 trillion, so this problem can be avoided for some time.

Markets focus on fundamentals, not political headlines

Shutdowns can affect economic data reporting, which may temporarily affect important data used by investors and economists such as the Bureau of Labor Statistics’ jobs report and Consumer Price Index. However, this typically only delays the data, with reporting resuming once the shutdown ends. They can also create modest headwinds for economic growth if they last long enough, as federal workers delay spending and government services are disrupted.

As the Economic Policy Uncertainty chart above demonstrates, tariffs and taxes earlier this year created significant challenges for investors. However, with recent clarity around both issues, this measure has fallen toward the longer run average. While a shutdown could always result in greater uncertainty, history shows that even longer government disruptions have not generally impacted investors.

The bottom line?

Government shutdowns may dominate headlines, create challenges for federal workers, and disrupt important services, but they have historically had minimal impact on financial markets. Investors should continue to focus on their financial plans rather than daily events in Washington.

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested in directly.

All investing involves risk, including loss of principal. No strategy assures success or protects against loss. The economic forecasts set forth in this material may not develop as predicted, and there can be no guarantee that strategies promoted will be successful.

Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company’s stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security–including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.

Share This: